The term budgeting is often used loosely to refer to different types of money management approaches. It’s important to understand what budgeting is and what it isn’t in order to understand the difference between Kualto and other personal finance tools like Mint or YNAB.

I found this great article written by Matt Becker over at Mom and Dad Money, that does a great job of explaining the difference between budgeting and expense tracking.

…in its purest sense keeping a budget means that you set hard limits on your spending. As an example, if your monthly grocery budget is $500, then you don’t allow yourself to spend more than $500 on groceries in any given month.

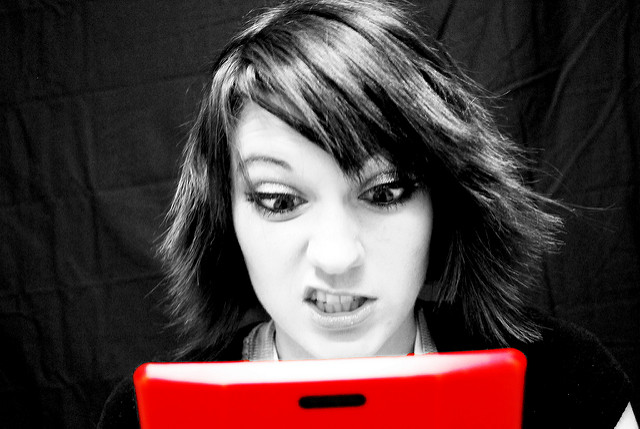

My problem with budgeting is that it’s not a flexible approach. It’s not realistic because there are always unexpected things that happen that cause us to go over our limits and “break” our budget. Then we feel guilty about not sticking to the plan.

On the other hand… Continue reading